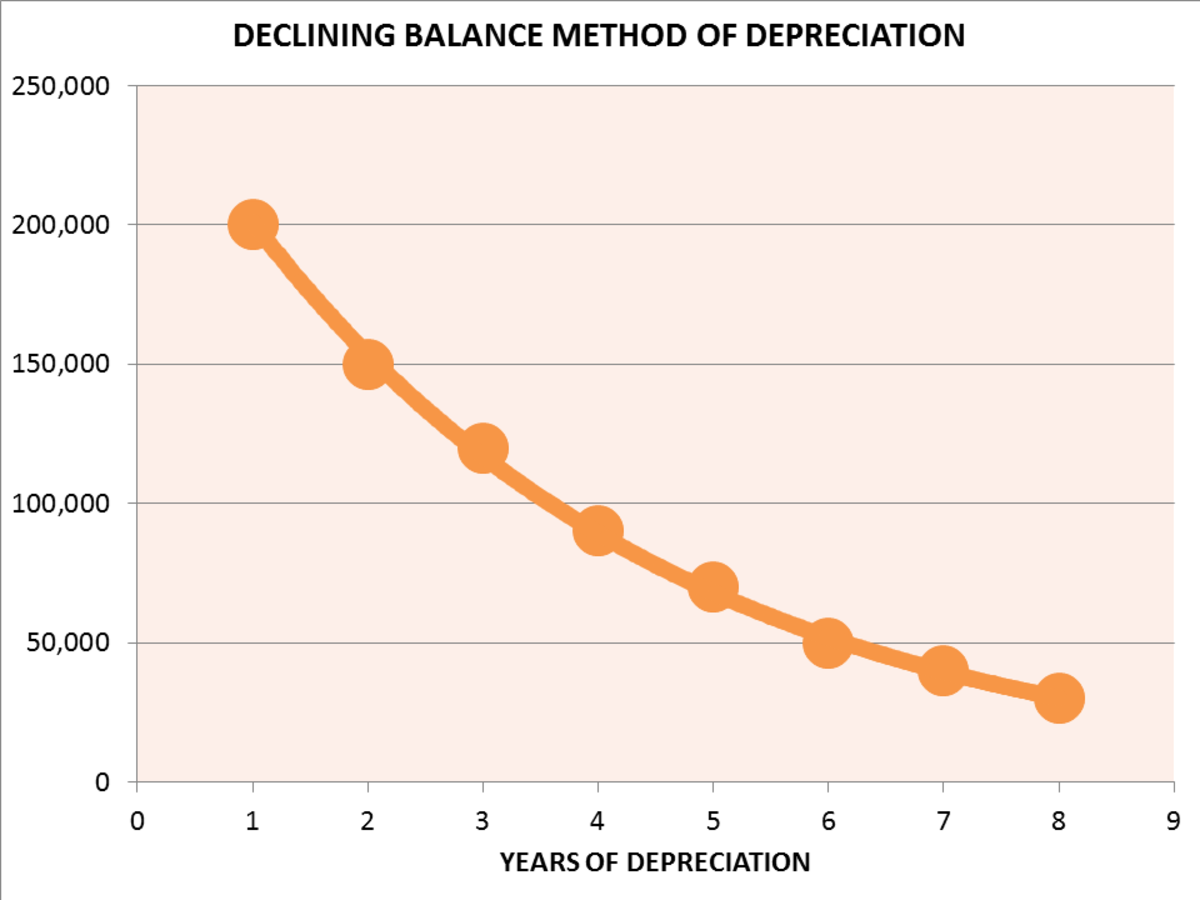

The declining balance method is used to recognize the majority of an assets depreciation early in its lifespan. Compared to the other three methods straight line depreciation is by far the simplest.

O Level Accounting Methods Of Calculating Depreciation

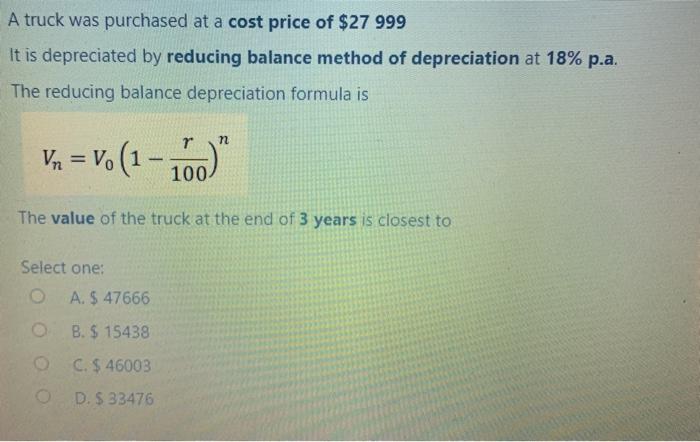

Solved A Truck Was Purchased At A Cost Price Of 27 999 It Chegg Com

Understand How To Calculate Depreciation Using The Straight Line And Reducing Balance Methods Youtube

Reducing balance depreciation method is most useful for assets that typically lose the most value in earlier years but then experience a slowing of depreciation later on.

Reducing balance method of depreciation. In this way the amount of depreciation each year is less than the amount provided for in the previous year. Reducing Balance Method Formula. The double-declining balance method and the 150.

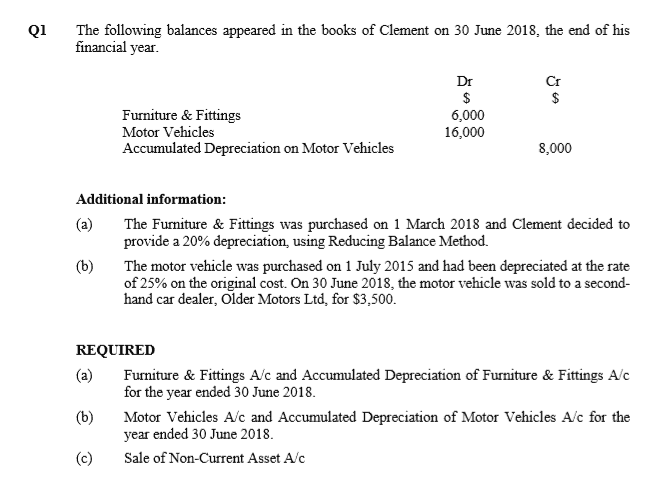

100000 40 912. All of this comes into play on the balance sheet. According to the Diminishing Balance Method depreciation is charged at a fixed percentage on the book value of the asset.

Depreciation for the year 2012 Rs. The other main method used is straight-line depreciation. The type of asset its useful life and the depreciation method used determines the length of time.

The declining balance method is an accelerated depreciation system of recording larger depreciation expenses during the earlier years of an assets. Reducing Balance Method. On the other hand straight-line depreciation results in equal depreciation expenses and therefore cannot account for higher levels of productivity and functionality at.

After two years of use company decided to change the depreciation method from straight-line basis to reducing balance method at the rate of 15. Computer equipment is a good example of an asset that would benefit from this method. This is the main.

Depreciation rate 20 2 40 per year. Under reducing balance method the depreciation is charged at a fixed rate like straight line method also known as fixed installment methodBut the rate percent is not calculated on cost of asset as is done under fixed installment method - it is calculated on the book value of asset. Under the reducing balance method the amount of depreciation is calculated by applying a fixed percentage on the book value of the asset each year.

A company bought an asset for 100000 with an expected useful life of five years. Under this method a constant rate of depreciation is applied to an assets declining book value each year. The second is the double-declining depreciation method.

Whichever method you choose to use for the fixed asset you need to. Calculate the depreciation expenses for 2012 2013 2014 using a declining balance method. Under the WDV method book value keeps on reducing so annual depreciation also keeps on decreasing.

How is straight-line depreciation different from other methods. The declining balance or reducing balance depreciation method considers the value of assets that are largely used or highly contribute to operation at the beginning and then subsequently decline. That means depreciation expenses that should be charged to certain types of assets are high at first and then low subsequently.

The reducing balance method of depreciation also known as declining balance depreciation or diminishing balance depreciation is a way of accounting for assets over a period of time. This method is also known as Diminishing Balance Method or Reducing. It is the most commonly used and straightforward depreciation method.

Useful life 5. Depreciation expenses keep reducing with each passing accounting period. The double declining balance depreciation method can help businesses depreciate assets more quickly for tax benefits making it especially useful.

Declining or reducing method of depreciation results is diminishing balance of depreciation expense with each accounting period. Things wear out at different rates which calls for different methods of depreciation like the double declining balance method the sum of years method or the unit-of-production method. This involves reducing the value of plant property and equipment to match its use as well as its wear and tear over time.

The method is based on the premise that certain assets not just have limited use and need to be depreciated with higher values during their useful life so as to show the true fair value of the asset on the balance sheet. Calculate the depreciation for the third and fourth year. The first one is the straight-line depreciation method.

Under this method the annual depreciation is determined by multiplying the. Depreciation Expense Book value of asset at beginning of the year x Rate of Depreciation100. The double declining balance depreciation DDB method also known as the reducing balance method is one of two common methods a business uses to account for the expense of.

Accumulated depreciation is a line item that adds to the assets of the company. Since accumulated depreciation reduces the value of the asset on the balance sheet accelerated depreciation impacts income statement and balance sheet-based financial ratios. As the book value reduces every year it is also known as the Reducing Balance Method or Written-down Value Method.

But also this depreciation method is apt for those assets which require higher repairs in the later stages of the asset life. Using the percentage Declining balance depreciation method. The reducing-balance method also known as the declining-balance method in the initial years of an assets service As with the straight-line method you apply the same depreciation rate each year to whats called the adjusted basis of your property.

Declining Balance Method of Depreciation also called as reducing balance method where assets is depreciated at a higher rate in the intial years than in the subsequent years. This means more depreciation occurs in the beginning of useful life of an asset. It is charged at a fixed rate like the straight line method also known as.

Straight line depreciation percent 15 02 or 20 per year. This simple depreciation calculator helps in calculating depreciation of an asset over a specified number of. The easiest way to think of it accumulated depreciation is the total amount of Chevrons cost for buying equipment or assets and depreciation assets are the amount reducing that accumulated cost.

Company X considers depreciation expenses for the nearest whole month. Sum-of-years-digits is a shent depreciation method that results in a more accelerated write-off than the straight-line method and typically also more accelerated than the declining balance method. Written Down Value Method WDV Under the Written Down Value method depreciation is charged on the book value cost depreciation of the asset every year.

Depreciation reducing balance method or Declining Balance is one of the main ways for calculating depreciation in your accounts. There are two variations of this. Find the carrying amount at the date of change.

The reducing balance method of depreciation reflects this more accurately than other depreciation methods. Let us learn more about this method.

Straight Line Vs Reducing Balance Depreciation Youtube

What Is Depreciation In Accounting Concept

What Is Double Declining Balance Method Of Depreciation Pakaccountants Com

Diminishing Balance Method Of Calculating Depreciation Also Known As Reducing Balance Method Accounting Simpler Enjoy It

Reducing Balance Depreciation Calculation Double Entry Bookkeeping

Declining Balance Or Reducing Balance Method Explanation Formula And Example

What Is Depreciation In Accounting Concept

Double Declining Balance Method Of Depreciation Accounting Corner